Well now, if you’ve ever watched a pack of raccoons tussling over the same half-eaten pie, you’ve glimpsed what’s happening in Silicon Valley today. Our most celebrated tech barons—who once promised to “do no evil” or “move fast and break things”—are now quietly building fences around the future of artificial intelligence. They aren’t just making gadgets or apps anymore; they’re scooping up data pipelines, hiring away each other’s brightest minds, and cutting labyrinthine deals that would make a 19th-century railroad tycoon blush. They’ve found ways to buy the whole pie—or at least keep others from taking a bite—without ever actually signing the deed. And like the riverboat gamblers of old, they’re doing it under the watchful, but often bewildered, eyes of regulators trying to figure out just who’s cheating whom.

So here we stand, watching today’s barons in hoodies and sneakers reenact the robber-baron pageant of yesteryear—only this time, it’s algorithms instead of oil wells, data centers instead of railroads. These AI companies are busy laying their tracks through exclusive contracts and backroom hires, all while regulators struggle to read the fine print. And if there’s one thing I’ve learned, it’s that when someone tells you they’re not buying the town, but just “partnering strategically” with every building in it, you’d best check your wallet and your watch. Because in the world of AI, it seems the real innovation isn’t just in technology—it’s in finding ever-cleverer ways to own the future without ever quite admitting it.

🔎 THE AI SITUATION

- Big Tech firms (Meta, Microsoft, Amazon, Google, Nvidia) are racing to dominate generative AI—not just by building technology, but by embedding themselves deeply in the ecosystem through exclusive investments, contracts, and “acquihire” deals.

- These deals often stop short of outright mergers but achieve effective control over key AI infrastructure: foundational models, data pipelines, and elite talent.

- This approach mirrors Standard Oil’s historical strategy of informal control without formal ownership, used by Rockefeller to build a monopoly until it was broken up in 1911.

- Analysts describe these modern deals as “non-acquisition acquisitions”, designed to avoid regulatory triggers under U.S. antitrust law—allowing firms to secure dominance without drawing immediate FTC scrutiny.

- Despite talk of deregulation, the FTC and DOJ remain vigilant, especially under traditional theories of harm like market foreclosure and talent consolidation. They’re adopting a “substance over form” approach that looks at economic realities rather than legal technicalities.

🏗 How Consolidation is Happening

1️⃣ Strategic Stakes Without Majority Ownership

- Meta’s ~$14 billion investment in Scale AI bought 49% of Scale’s non-voting shares—avoiding merger formalities while effectively integrating Scale’s data-labeling pipeline and talent into Meta’s AI efforts.

2️⃣ Exclusive Access Contracts

- These deals often give the buyer exclusive rights to crucial inputs (e.g., datasets, pipelines) that competitors also rely on. By locking up these resources, big firms can foreclose access and slow rivals.

3️⃣ Talent Acquisitions (“Acquihires”)

- Hiring the leadership and key staff of strategic startups prevents competitors from accessing top talent—and can hollow out independent players without buying the whole company.

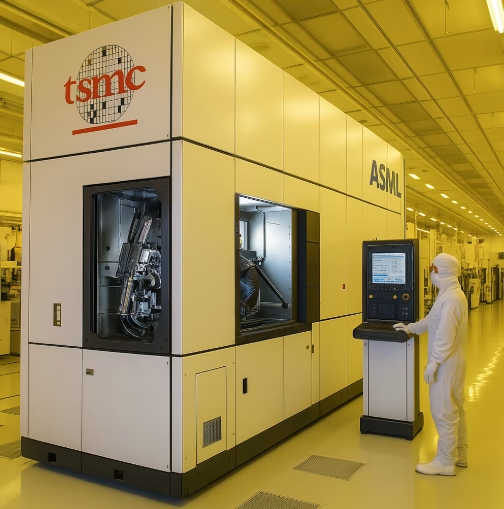

4️⃣ Preferential Cloud and Hardware Access

- Amazon and Google invested billions in Anthropic (Claude), and in return, Anthropic is tied to AWS and Google Cloud. Nvidia invested in Coreweave, a firm that rents out Nvidia GPUs—creating a self-reinforcing loop ensuring demand for Nvidia’s chips.

5️⃣ Embedded Influence Through Boards

- Deals often include keeping acquired talent on the startup’s board while they lead Big Tech’s internal AI teams—blurring the line between independence and control.

⚖️ How Entrenchment Works

- Economic Moats: By controlling foundational AI inputs (compute, data, talent), Big Tech is building barriers to entry—even if models are open-sourced or replicable, training and deploying them at scale requires exclusive infrastructure.

- Contractual Leverage: Microsoft’s deal with OpenAI secures commercial rights to GPT models, integrating them into Azure and Office—despite holding no formal equity in OpenAI’s nonprofit parent.

- Disruptive Playbook: Deals like Meta’s with Scale AI cause months-long workflow delays for rivals (OpenAI, Google, Anthropic), forcing them to switch suppliers or rebuild pipelines—creating strategic disruption even before deals close.

- Investment Ecosystems: Nvidia’s stakes in GPU-hungry startups encourage dependency on its hardware, reinforcing market dominance and steering innovation toward its products.

- Influence Over Future Standards: By embedding early in AI labs and startups, Big Tech can shape industry norms, architectures, and APIs—potentially controlling what becomes the de facto AI standard.

🛑 Antitrust Risks

The FTC’s Merger Guidelines 3, 4, 5, 6, and 11 highlight concerns around:

- Shared board members → risk of collusion.

- Blocking access to key inputs → market foreclosure.

- Hiring key staff → undermining competition.

- Minority stakes providing de facto control.

- Strengthening dominant firms → further entrenching market power.

Even if the FTC blocks some deals, damage may already be done by disrupting competitors’ operations, delaying progress, or extracting strategic intelligence.

🗝 Why This Matters

- While AI remains a competitive space today, the shape of future competition depends on who controls critical infrastructure—data, compute, and training pipelines.

- The winner-take-all fear among Big Tech is driving these investments, similar to Google’s long-term dominance in search.

- Yet, unlike search, foundational AI models may prove easier to replicate than expected, risking overinvestment and reducing the chance of a single dominant firm.

- Regulators face a new challenge: competition law built for clear-cut mergers struggles with today’s web of contracts, partial stakes, and talent deals.

📌 Bottom Line

Big Tech isn’t just competing by building better AI models—they’re consolidating control over the entire AI value chain, entrenching themselves through contracts, exclusive access, and talent moves. These strategies are reminiscent of historical monopolistic tactics—but updated for the digital era. While the industry is still competitive, these moves could reshape AI’s future into an oligopoly of entrenched giants, unless regulators adapt quickly.

🔹 Big Tech Giants Dominating AI

- OpenAI – Creator of GPT-4o and other foundation models; partnered deeply with Microsoft.

- Anthropic – Maker of Claude models; invested in by Amazon and Google.

- Google DeepMind – Pioneers behind AlphaGo, AlphaFold, and Gemini models.

- Meta (Facebook) – Aggressively investing in generative AI, open-source LLaMA models, and data-labeling pipelines.

- Microsoft – Integrating AI across Azure, Office, GitHub Copilot, and partner of OpenAI.

- Amazon AWS – Building its own foundation models, Bedrock platform, and investing billions in Anthropic.

- Nvidia – King of AI hardware (GPUs) and investor in dozens of AI startups.

- Apple – Developing on-device generative AI, focusing on privacy-preserving AI in iOS/macOS.

- IBM – Longtime AI player with WatsonX platform and enterprise-focused AI solutions.

- Tesla/xAI – Elon Musk’s AI venture, building Grok chatbot and AI models integrated with Tesla products.

🔹 Top AI Labs and Startups Shaping the Field

- Cohere – Creator of Command R and Command R+ open-weight language models.

- Mistral AI – France-based lab known for powerful open-weight language models like Mistral 7B and Mixtral.

- Hugging Face – The central platform for hosting, sharing, and deploying AI models.

- Character.AI – Specializes in AI chatbots designed to emulate distinct personalities.

- Scale AI – Data-labeling and annotation powerhouse, key to training supervised AI.

- Perplexity AI – Building conversational AI-powered search and answering engines.

- Runway ML – Leader in AI video generation, including tools like Gen-2 for creative industries.

- Adept AI – Focused on building agents that take actions across digital interfaces (e.g., web browsers, apps).

- Inflection AI – Makers of Pi, an AI personal assistant, backed by Microsoft and Nvidia.

-

EleutherAI – Open research collective behind GPT-NeoX, GPT-J, and other open-source LLMs.

🔹 AI Infrastructure and Specialized Players

- Stability AI – Creators of Stable Diffusion; leaders in open-source text-to-image generation.

- CoreWeave – Cloud GPU provider specializing in renting Nvidia GPUs for AI workloads.

- Reka AI – Founded by ex-Google Brain researchers, creating multimodal LLMs.

- DataRobot – Automated machine learning platform for enterprises.

- Databricks – Major player in data lakes and ML infrastructure, integrating AI across cloud ecosystems.

WHO IS FUNDING WHO

| # | Company | Description | Headquarters | Recent Funding/Notes |

|---|---|---|---|---|

| 1 | OpenAI | Pioneer of GPT models; foundational models for text & multimodal AI | San Francisco, USA | Backed by $13B+ from Microsoft |

| 2 | Anthropic | Creator of Claude; focus on alignment & safety of LLMs | San Francisco, USA | Raised billions from Amazon & Google |

| 3 | Google DeepMind | Cutting-edge research lab behind AlphaFold, Gemini models, more | London, UK | Part of Alphabet (Google parent) |

| 4 | Meta (Facebook) | Building LLaMA open-weight models; investing in data & AI infrastructure | Menlo Park, USA | $14B+ investment in Scale AI |

| 5 | Microsoft | Deep AI integrations in Azure, Office, GitHub; key OpenAI partner | Redmond, USA | Invested heavily in OpenAI |

| 6 | Amazon AWS | AI services on Bedrock; strategic investor in Anthropic | Seattle, USA | Multi-billion Anthropic investment |

| 7 | Nvidia | Dominates AI GPUs; invests in AI startups like CoreWeave | Santa Clara, USA | Market cap surged to ~$3T |

| 8 | Apple | Developing on-device, privacy-centric AI for iPhones, Macs, Vision Pro | Cupertino, USA | Focus on in-house AI, less on open deals |

| 9 | IBM | WatsonX platform; enterprise AI with decades of experience | Armonk, USA | Focus on B2B AI solutions |

| 10 | Tesla/xAI | Elon Musk’s AI lab; Grok chatbot; Tesla’s AI for self-driving & robotics | Palo Alto, USA | New AI investments; hiring top talent |

| 11 | Cohere | Builds enterprise LLMs & retrieval-augmented generation (RAG) systems | Toronto, Canada | Raised $270M in Series C |

| 12 | Mistral AI | European leader in open-weight LLMs like Mistral 7B, Mixtral | Paris, France | Raised €500M Series A |

| 13 | Hugging Face | The AI model sharing hub; open-source tools for NLP & ML | NYC, USA | Valued at $4.5B+ |

| 14 | Character.AI | Chatbots with distinct personalities; viral consumer AI app | Menlo Park, USA | Raised $150M in Series A |

| 15 | Scale AI | Data-labeling and annotation services; fuels training for top AI labs | San Francisco, USA | Majority investment from Meta in 2025 |

| 16 | Perplexity AI | AI search and question-answering engine competing with Google | San Francisco, USA | Raised $70M Series B |

| 17 | Runway ML | AI video generation tools like Gen-2; creative media applications | NYC, USA | Raised $141M Series C |

| 18 | Adept AI | Building digital agents for real-world app interaction | San Francisco, USA | Raised $350M Series B |

| 19 | Inflection AI | Makers of Pi, a personal AI assistant; safety-focused foundation models | Palo Alto, USA | Raised $1.3B+ from Microsoft & Nvidia |

| 20 | EleutherAI | Open research group behind GPT-NeoX, GPT-J, Pythia models | Distributed/Remote | Nonprofit collective |

| 21 | Stability AI | Stable Diffusion; leader in open-source generative image models | London, UK | Raised $100M+ in early rounds |

| 22 | CoreWeave | Cloud GPU rental provider; key supplier of Nvidia GPUs for AI training | Roseland, USA | Raised over $2B; Nvidia strategic stake |

| 23 | Reka AI | Multimodal AI models; founded by ex-Google Brain researchers | San Francisco, USA | Recently raised $58M Series A |

| 24 | DataRobot | Automated ML for enterprises; platform for end-to-end AI deployments | Boston, USA | Raised $750M+ over multiple rounds |

| 25 | Databricks | Data lakes, Spark, ML infrastructure; bridges AI & data analytics | San Francisco, USA | Valued at $43B pre-IPO |

© 2025 insearchofyourpassions.com - Some Rights Reserve - This website and its content are the property of YNOT. This work is licensed under a Creative Commons Attribution 4.0 International License. You are free to share and adapt the material for any purpose, even commercially, as long as you give appropriate credit, provide a link to the license, and indicate if changes were made.