It’s a curious thing, watching the world panic while the clever few quietly get rich. The stock market crashes, folks start scream like a cat in a rain barrel, and every talking head on TV starts peddling fear like it’s going out of style. But here’s the rub: the best bargains are always found in the darkest corners of a storm.

Old Wall Street’s got a saying—“Be greedy when others are fearful.” That’s just a fancy way of saying what my uncle used to holler when the chicken coop burned down: “Time to grab the eggs, boys!”

So while the herd runs off the cliff, we’re gonna sit here a spell, look at the facts, and figure out how to turn this mess into money. Now if you’ve stuck with me this far, congratulations—you’re already a mile ahead of the stampede. Most folks get spooked by shadows and sell their future for a mess of pottage. But you? You’re learning to see the opportunity hiding behind the smoke.

The market’s down, the news is grim, and everyone’s running’ scared. That’s precisely why it’s the time to sharpen your shovel and start digging’ for gold. Because like I always say: panic is just profit in disguise.

So go on, be greedy when others are fearful. Just do it with some sense, a plan, and after all, the best way to beat the game is to know it’s rigged and play it anyway—with a grin.

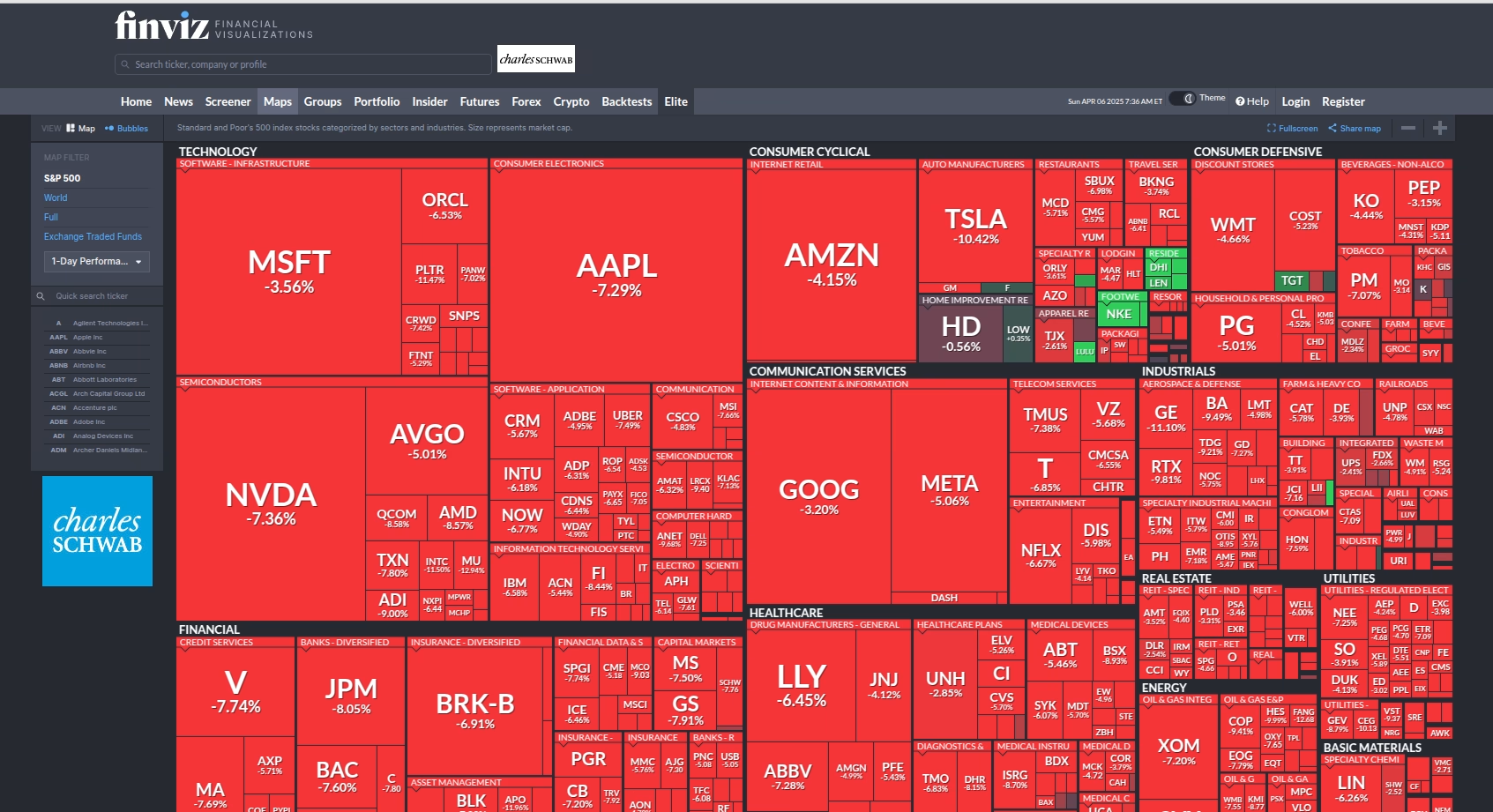

A Brutal Day on Wall Street

An exceptionally brutal day hit Wall Street as major stock markets suffered steep losses triggered by newly announced tariffs. Analysts are calling it the worst day for U.S. equity markets since the onset of the pandemic.

While the fear spreads, it’s important to remember: millionaires are made when the stock market crashes. The bigger the crash, the bigger the opportunity—especially if you can be greedy when others are fearful. That’s the best way to get rich without getting lucky.

So lets look at the following:

- Why the latest tariffs caused a big market crash

- How far stocks could fall and how long the crash could last

- Exactly how to be greedy when others are fearful

- Which stocks to watch or buy while prices tank

This could be a once-in-a-lifetime opportunity.

Why the Market is Crashing: The Tariff Shock

Stock markets around the globe are crashing following the announcement of reciprocal tariffs affecting nearly every trading partner of the United States.

What’s Driving the Crash?

- China imports: Now have a 34% tariff on top of the existing 20%.

- EU imports: Face new 20% tariffs.

- Southeast Asia (Vietnam, Cambodia, etc.): Hit with 46-49% tariffs.

China and the EU accounted for roughly a quarter of all U.S. imports last year. These tariffs affect key sectors like textiles, machinery, and electronics.

Trump’s Economic Plan and Its Foundations

Trump’s strategy is rooted in a paper titled “A User’s Guide to Restructuring the Global Trading System” by Steven Moran, current Chair of the White House Council of Economic Advisors.

Three-Part Plan:

- Use tariffs as a negotiating tool

- Level the playing field with reciprocal tariffs

- Weaken the U.S. dollar to boost exports

We’re currently in part two, which involves mutually-assured economic pain to drive other countries to the negotiation table.

Why the Plan Might Fail

Despite being labeled “reciprocal,” the tariff rates appear to follow a simple formula:

- Trade Deficit ÷ Country’s Exports to U.S.

- Divide result by 2 to get the tariff rate

Examples:

- China

Deficit: $295.4B | Imports: $439B

Formula: 295.4 ÷ 439 ≈ 67.3% → 34% tariff - United Kingdom

Even with a $12B surplus in favor of the U.S., the UK still received a 10% tariff.

115 countries with trade surpluses to the U.S. were hit with 10% tariffs anyway. These inconsistencies undermine the logic and sustainability of the plan.

The Resulting Blowback

In retaliation:

- China imposed 34% tariffs on all U.S. goods

- Other countries are likely to follow

This will lower demand for U.S. exports, reduce company earnings, and cause stock prices to fall further.

Diversify to Protect Yourself

Tariffs hit public companies hard. Alternatives like real estate become attractive, especially low-entry funds like the Fundrise Flagship Real Estate Fund.

- $7 billion in managed real estate

- Invest in single-family rentals, affordable apartments, industrial warehouses, and more

How Long Will the Crash Last?

Historic Market Behavior:

- Bull markets: Avg. 4.3 years, +150% returns

- Bear markets: Avg. 11 months, -32% losses

Recovery Timeline:

- Post-WWII, the average bear market:

- 13 months to bottom

- 24 months to recover

- Even the shortest crash takes months, not days

You have time to build cash and prepare.

Timing the Market: Fear vs. Greed

Use CNN’s Fear & Greed Index:

- Current rating: Extreme Fear

- A composite of 7 indicators:

- Momentum, volatility (VIX), put-call ratios, and more

Key Metrics:

- S&P 500 vs. 125-day moving average: Tells market direction

- VIX Index (Volatility):

- Spikes = Panic

- Stabilization = Recovery

Wait for VIX to calm and market momentum to trend upward before investing aggressively.

Stocks to Buy While Others Panic

Start with index funds, then branch into targeted opportunities.

Google (Alphabet)

- PE Ratio: 18 (2nd lowest in a decade)

- 43% undervalued (DCF model)

- Potential 77% upside

Meta Platforms

- DCF Value: $880/share

- Also 43% undervalued

- Analysts predict 10% earnings growth—actual growth is more than double

Taiwan Semiconductor (TSMC)

- Makes 90% of world’s advanced chips

- Hit by fear of tariffs

- Price: Under $150

- Fair Value: ~$225 → 50% upside

Nvidia

- PE Ratio: 32 (lowest since 2019)

- DCF estimates: 20% undervalued

- Likely far more upside due to GPU demand

SO: Be Greedy When Others Are Fearful

- Tariffs are causing panic—but the panic won’t last

- History shows markets recover—and reward the patient

- Use data, not emotion, to guide your decisions

- Stocks like Google, Meta, TSMC, and Nvidia are top-tier opportunities if bought at steep discounts

Millionaires are made in times like these—when you can be greedy while the world is fearful. You can get rich without being lucky. But it is still time to wait. No One knows were the bottom is. If you haven’t read this yet, read it.

MY Favorite Tool is called FINVIZ, just go to FINVIX.com – I pay for the full thing, but you can get away with free on

EXTRA CREDIT

What is NEXT for the Markets and the World

Long-Term Oil Investment Outlook Post-Tariffs: Chevron, ExxonMobil, or Occidental?

Watching the Fall: Is Apple in My Future?”

The Three-Day Rule: A Modern Parable for a World in Panic

It’s All About Timing: Lessons from the Market and the Wind

>