Let me tell you a tale of the little island that could—Taiwan—home to a company that doesn’t sell shoes, ships, or social media… but sells the future one microscopic chip at a time. TSMC is its name, and it’s become the beating silicon heart of the modern world. Every smartphone in your hand, every data center whispering AI dreams, and even your car that thinks it’s smarter than you—it’s all powered by TSMC’s handiwork.

Donald Trump—love him or loathe him—calls it the most important company on Earth. And for once, the man might not be exaggerating. Because if you unplug TSMC, you don’t just turn off Taiwan… you dim the lights on global progress. But here’s the kicker: the world’s most vital company is also standing on the world’s most dangerous fault line, both figuratively and geopolitically. That makes investing in it feel like buying a front-row seat to a symphony… with a slight chance of missile fire.

So yeah, I’m planning to buy some more. Not because it’s safe—but because it’s essential. The only real question is when. Before the tariffs? After the tanks? Or when sanity and silicon finally learn to share a border?

Now I ain’t no soothsayer, and I’ve long since retired my crystal ball—mostly because it was made in China and cracked. But I do know this: there are two kinds of companies in this world—those that follow trends, and those that build the roads the trends drive on. TSMC doesn’t just build the road, it pours the concrete, lays the fiber, and charges tolls to the likes of Apple, NVIDIA, and Amazon just for the privilege of driving.

Yes, it’s in a risky neighborhood. Yes, it’s first on the chopping block in any trade war or cross-strait crisis. But when the world runs on chips, and one company makes the smartest ones, you don’t ignore it—you just watch it closely and keep your powder dry. I’ll buy more—when the price dips, when the winds settle, or when the storm is priced in.

Because some companies are too big to fail. TSMC? It’s too important to ignore.

Below is an excerpt of the analysis I got from my favorite AI. It is actually much larger, I copies highlights here.

Comprehensive stock analysis of TSMC (Taiwan Semiconductor Manufacturing Company) with a 5-year investment perspective. I’ll include:

- Geopolitical risks, particularly regarding China-Taiwan relations

- TSMC’s competitive landscape (major rivals and potential disruptors)

- Production capabilities and future roadmap (e.g., nodes, foundry expansion)

- Major clients (Apple, NVIDIA, etc.) and industry reliance

- Valuation (PE ratio, historical comparison, forward guidance)

- Impact scenarios regarding tariffs or trade restrictions

TSMC 5-Year Investment Outlook

Geopolitical Risks

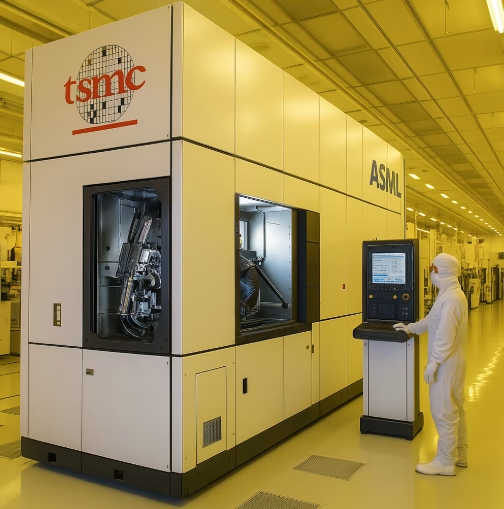

TSMC, based in Taiwan, faces significant geopolitical risks due to tensions with China. Any conflict or blockade could disrupt the global chip supply chain. While the U.S. and allies are investing in domestic production, replicating TSMC’s capabilities is difficult. TSMC is also diversifying its manufacturing footprint with new fabs in the U.S., Japan, and Europe to reduce its reliance on Taiwan.

Competitive Landscape

TSMC holds around 60% of the global foundry market. Main competitors include:

- Samsung Foundry: Competing in 3nm and 2nm technologies but struggles with yield.

- Intel Foundry Services: Reentering foundry space with significant investment but faces execution challenges.

- GlobalFoundries, UMC, SMIC: Compete in mature nodes; not a threat at the leading edge.

Some large clients like Apple and Amazon design their own chips but still rely on TSMC for manufacturing.

Production Capabilities and Roadmap

TSMC is currently producing 3nm chips and will begin 2nm chip production by 2025. It leads the industry in yield and reliability. Its future includes advancements in 2nm and beyond, as well as investments in advanced packaging (e.g., CoWoS) essential for AI chips.

Major Clients

TSMC’s top clients include:

- Apple: ~25% of revenue; exclusive fab partner for A and M series chips.

- NVIDIA: Rapidly growing client due to AI demand.

- AMD, Qualcomm, MediaTek: Consistent volume contributors.

This client base provides stable revenue, although Apple and NVIDIA represent a significant concentration risk.

Valuation

As of 2025, TSMC trades at:

- P/E Ratio: ~22x trailing

- Forward P/E: ~17–19x

This is reasonable compared to peers like NVIDIA (~24x forward) and Intel (~40x forward). Expected revenue growth is in the mid to high teens annually.

Revenue Stability: The broad range of end-markets served – smartphones, HPC/AI, PCs, auto, industrial – provides a natural hedge: if one segment slows, another may be rising. For instance, smartphone demand has matured, but high-performance computing (HPC) is now over half of TSMC’s revenue (51% in Q3 2024) driven by AI and data center chipsino.com. This shift reduces reliance on any single industry. That said, TSMC is becoming somewhat dual-dependent on Apple and Nvidia in the near term. Combined, these two might approach ~50% of revenue in a couple of years if Nvidia’s orders keep growinginvesting.com. Such concentration means TSMC must carefully manage these relationships and watch for any changes in their sourcing strategies. Investors should keep an eye on Apple’s silicon roadmap and Nvidia’s AI demand trajectory, as these will strongly influence TSMC’s 5-year financial performance. So far, the reliance has been a positive: TSMC’s record earnings in 2024 were fueled by Apple’s iPhone launch and Nvidia’s AI boomino.comino.com. The symbiotic link between TSMC and its top clients is a cornerstone of its stability – but it is a point of potential vulnerability if a top client encounters trouble or curtails orders.

Valuation and Growth Outlook

TSMC’s stock has delivered strong returns in recent years, and at current prices it trades at a valuation that reflects both its quality and the geopolitical risk discount. We examine TSMC’s key valuation metrics and compare them to other leading semiconductor companies:

| Company | Market Cap (Apr 2025) | P/E Ratio (TTM) | Forward P/E (2025E) | 5-Year Revenue Growth (est.) |

|---|---|---|---|---|

| TSMC (Taiwan) | ~$700–800Binvestor.tsmc.com | ~22×morningstar.com | ~17–19×tradingnews.com (FY25) | High-teens % CAGR (driven by AI & 2nm ramp)investing.com. |

| Intel (USA) | ~$120B | N/M (very high due to earnings slump)finance.yahoo.com | ~40×finance.yahoo.com (forward) | Low single-digit % (hoping to rebound in 2025–26). |

| Samsung Electronics (S. Korea) | ~$300B | ~10×companiesmarketcap.com | ~13×financecharts.com | Mid single-digit % (cyclical; dependent on memory upcycle). |

| NVIDIA (USA) | ~$600–800B (volatile) | ~55×macrotrends.net | ~24×fool.com | ~30%+ CAGR (AI-driven, from high base). |

| AMD (USA) | ~$150B | >90× (TTM outlier)gurufocus.com | ~20×gurufocus.com | ~20% CAGR (driven by data center & Xilinx). |

Tariffs and Trade Restrictions

TSMC is affected by U.S. export controls on advanced chips to China. While these reduce Chinese business, they also limit China’s tech development, preserving TSMC’s lead. U.S. tariffs or “Buy American” policies could impact Taiwanese-made chips, but TSMC’s Arizona fab is designed to mitigate this risk.

TSMC sits at the intersection of U.S.–China tech tensions, which creates several possible trade-related risks. Here we explore scenarios involving tariffs, export controls, and other trade restrictions – and their potential impact on TSMC:

-

U.S. Export Controls on China: The U.S. has increasingly restricted China’s access to advanced semiconductors, and TSMC has had to comply given its use of U.S.-origin technology. In 2020, for example, TSMC was barred from supplying Huawei (formerly a major customer ~14% of revenue) with any chips made using U.S. tools/IP, dealing a blow to TSMC’s China business. More recently, in 2022–2023 the U.S. imposed export controls that ban leading-edge chips (roughly <16 nm or chips above certain AI performance thresholds) from being sold to Chinese entities without a license. TSMC, therefore, cannot accept orders from Chinese chip designers for its 7 nm, 5 nm, 3 nm processes if those chips are destined for advanced uses. This has curtailed Chinese companies’ ability to use TSMC – e.g., Alibaba, HiSilicon, Biren and others have had to shelve some chip projects. In practice, China-based clients now contribute a much smaller portion of TSMC’s revenue (China was ~10% of sales in 2022, down from 20%+ when Huawei was active). While TSMC has largely filled the gap with other business (Apple, etc.), future U.S. restrictions could tighten further, potentially limiting even more technology levels. There is talk that older nodes (e.g. 28 nm) might be added to controls if they are used in military contexts, which could impact TSMC’s more mature business in China. The upside of these controls (from TSMC’s perspective) is that they hamper China’s domestic competitors: e.g., SMIC cannot buy EUV lithography machines, ensuring TSMC retains its tech leadbusinessinsider.combusinessinsider.com. Also, foreign competitors like Intel and Samsung are similarly restricted from selling top chips to China, so TSMC’s loss of certain Chinese customers doesn’t necessarily become someone else’s gain – it might just reduce overall demand. However, if geopolitical tensions worsen, TSMC could see a full cut-off of its China market for advanced chips. China accounts for roughly 10–15% of TSMC’s current revenue (mostly more mature chips for Chinese firms or multinational OEMs manufacturing in China), so in a worst-case decoupling scenario, TSMC might lose that chunk of business. It’s a manageable portion, but not trivial.

-

Chinese Counter-Measures: China has retaliated in the tech war by leveraging its grip on certain materials. In mid-2023, Beijing imposed export restrictions on critical minerals like gallium and germanium (used in chip production and optics)csis.orgz2data.com. This was largely symbolic – TSMC and others found alternative sources or had stockpiles – but it signaled China’s willingness to use its own export controls. More worryingly, China could restrict the export of advanced chip substrates or chemicals where it has a market share, which might raise TSMC’s input costs. So far, these measures have not significantly impacted TSMC, but they add complexity to the supply chain. Another potential move by China is to boycott or favor certain companies: for instance, China banned Micron’s memory chips in some infrastructure – conceivably, they could discourage Chinese firms from buying products that rely on TSMC chips (to indirectly hit TSMC). Yet given TSMC’s products are inside most cutting-edge electronics, such selective boycotts are hard to implement without hurting Chinese industries themselves. A more direct threat would be if Beijing placed sanctions on TSMC or its executives, but that is unlikely unless conflict erupts. In summary, China’s near-term trade actions may cause incremental headwinds (higher costs, slightly lower Chinese sales) but are unlikely to severely damage TSMC’s core business absent a dramatic escalation.

-

Tariffs on Taiwanese Chips: One scenario raised in U.S. political discourse is imposing tariffs on semiconductors made in Taiwan. Notably, former President Trump recently floated the idea of up to 100% tariffs on chips from Taiwan to pressure TSMC to move production statesideitif.org. If such a policy were enacted, it would massively increase costs for U.S. companies that rely on TSMC – effectively a tax doubling the price of chips that go into iPhones, PCs, cars, data centers, etc. Studies show this would be highly counterproductive: a tariff of that magnitude could raise U.S. chip prices ~50–60% and significantly inflate consumer prices for electronicsitif.org. It could also backfire strategically – unless applied universally, it might make Chinese-made chips cheaper than Taiwanese chips in the U.S., inadvertently helping Chinese suppliersitif.org. In addition, TSMC (and other Taiwanese firms) might simply route production through third countries or focus on non-U.S. markets rather than relocate fabs immediatelyitif.orgitif.org. The consensus among industry experts is that such aggressive tariffs would “backfire” and hurt the U.S. more than helpitif.orgitif.org. Therefore, while campaign rhetoric may mention tariffs, the likelihood of a blanket 100% chip tariff being actually implemented is low (it would face resistance from U.S. tech companies and consumers). More moderate tariffs or incentives are possible – for example, an import tax combined with a subsidy could be used to even the playing field for U.S.-made chips. If any tariff is imposed, TSMC’s strategy would likely be to speed up production at its Arizona fab (which would be exempt as “Made in USA”) to serve the U.S. market, while supplying other markets from Taiwan. This scenario is one to watch in 2025–2026 with the U.S. elections and policy shifts, but it’s a manageable rather than lethal risk for TSMC, assuming it maintains some overseas capacity.

-

Restrictions on TSMC’s Investments: Another facet of trade tensions is the restriction on where TSMC can invest. As a recipient of U.S. CHIPS Act funds for its Arizona fab, TSMC is subject to “guardrail” rules that forbid it from significantly expanding advanced fab capacity in China for a decadegrowthstudio.crowell.comcsis.org. TSMC has already indicated it will limit its China operations to 28 nm and older technologies in compliance. This means TSMC’s growth in China is capped – effectively a minor drag, as its focus is on leading-edge anyway. Conversely, it nudges TSMC to invest more in the U.S. and allied countries. We might also see U.S. export controls on equipment extended: for instance, if there were any concern about TSMC’s Taiwan fabs being overrun by China, the U.S. could conceivably restrict shipment of chipmaking tools or updates to TSMC – but this is a drastic step that would only be on the table in extreme scenarios (as it would undermine TSMC’s production and thus U.S. companies too). On the European front, if EU–China relations sour, Europe could impose its own export controls or require “European soil” manufacturing for certain chips (benefiting TSMC’s future German fab).

In all these scenarios, the theme is fragmentation of the semiconductor supply chain. TSMC, as the central node, has to adapt to a more segmented world. The company is already adjusting by geographically distributing some capacity and by working closely with governments (for example, TSMC’s Arizona fab was prompted in part by U.S. government and major customers’ urging). For investors, the key takeaway is that trade restrictions could raise operational costs (duplicating supply chains, compliance overhead) and constrain certain markets, but they are unlikely to stop TSMC’s growth outright. The worst-case trade scenario – a full decoupling where East and West have completely separate tech ecosystems – would require TSMC to choose a side (almost certainly aligning with the U.S. and allies). In that extreme case, TSMC might lose the China market entirely but would become even more vital to the U.S./Europe supply chain (potentially with government support to compensate). Short of that, we expect a continued “tightrope” walk: TSMC navigating export rules, investing in multiple regions, and lobbying against harmful tariffs, while supplying as many customers as allowed. This agility in strategy will be important to watch as part of the investment risk profile.

Conclusion

TSMC stands at the pinnacle of the semiconductor industry with a technological and market position that few, if any, companies can match. Its dominance in cutting-edge chip manufacturing – from 3 nm today to 2 nm and beyond in coming years – positions it at the heart of virtually every major tech trend, be it AI, 5G, autonomous vehicles, or high-performance computing. Over the next five years, TSMC is poised to capitalize on these trends through its unmatched process technology roadmap and deep relationships with top-tier customers like Apple, Nvidia, AMD, and Qualcomm. The growth prospects (high teens to 20% annual earnings growth expected) are underpinned by secular demand and TSMC’s ability to command premium pricing for its leading nodes.

However, investors must carefully weigh the risks. The geopolitical shadow of China–Taiwan tensions is an ever-present risk factor – a low-probability but high-impact event that would be devastating to TSMC’s operations. Short of an actual conflict, trade and political frictions could introduce volatility, whether through export bans, client diversification, or protectionist tariffs. TSMC is responding proactively by diversifying production locations and working closely with governments, but this will be an area requiring ongoing vigilance. The competitive landscape, too, is evolving: Samsung is determined to improve its foundry footing, Intel is reinvigorated by government support to become a contract manufacturer, and even customers like Apple are exploring second-source options. TSMC will need to execute on 2 nm and 1 nm transitions flawlessly to fend off these challenges and maintain its edge.

From a stock perspective, TSMC offers a compelling long-term investment case for those willing to accept the risk. Its valuation is reasonable relative to peers, its financial performance is best-in-class (40%+ margins, >30% ROE)ino.comino.com, and it plays an indispensable role in the digital economy. In a 5-year timeframe, an investor in TSMC is essentially betting that the world will continue to demand ever more advanced chips – and that TSMC will remain the principal company supplying that demand. The risks – geopolitical, competitive, and macroeconomic – are real, but TSMC’s strategic importance acts as a buffer (governments and customers have strong incentives to support and not hinder TSMC). For a risk-tolerant investor, TSMC represents an opportunity to own a cornerstone of the tech industry’s future growth. As with any investment, one should stay informed and monitor developments (political changes, tech breakthroughs at competitors, major shifts in customer strategies) that could alter the thesis. But as of now, TSMC’s combination of technological leadership, robust financials, and strategic initiatives makes it a formidable player positioned to navigate challenges while delivering value over the coming years.

© 2025 insearchofyourpassions.com - Some Rights Reserve - This website and its content are the property of YNOT. This work is licensed under a Creative Commons Attribution 4.0 International License. You are free to share and adapt the material for any purpose, even commercially, as long as you give appropriate credit, provide a link to the license, and indicate if changes were made.